Purchasing

Navigating a New Spending Request

Purchase Order

All requests for spending for goods and services must be requested via a Purchase Request Form. Once the purchase request is approved by the email workflow approval process, a purchase order will be generated and processed by Procurement Services.

Exceptions are outlined below and payment will be made using the alternative payment methods described.

Purchasing Card (PCard)

Eligible Expenses are outlined in the Purchasing Card (PCard) Financial Policy can be purchased by University Purchasing Card.

Non-Travel Related Reimbursement Requests

The Cheque Requisition Form is used for miscellaneous non-travel expense reimbursement. This form should be used to request reimbursement for only the following list of specific items:

a. Referee expense claims

b. Course registrations

c. Webinars

d. Memberships/dues payments

e. Hotel and conference facility bookings (not accommodations)

f. Request reimbursement for miscellaneous purchases eligible for payment by PCARD where credit cards are not accepted or unavailable.

Refer to the AUT PD & Travel Expenses for details on professional development and travel expense claims relating to sections 1.2.2 and 2.1.2 of the AUT Collective Agreement.

The Honoraria and Awards Payment Request form should be used to request cheques for:

a. Student awards

b. Honorarium payments for visiting lecturers and guest speakers

Missing Documentation Instructions

If supporting documentation required to fulfill a payment process is lost, please include the completed Lost Receipt Declaration Form along with other forms required according to the payment method pursued.

Purchase Requests

Policy

All expenses on behalf of the University must adhere to the Purchasing Policy.

Forms

The Purchase Requisition Form - this from should be used to request a purchase of goods and/or services.

Procedures

- Prepare the purchase request using the purchase requisition form linked above.

- Review the Purchase Requisition End User Guide linked below to familiarize yourself with the form and process.

- Attach any quotes, or additional specification documents which can assist the purchasing department.

- Completed forms should be sent by email to the Purchasing Department along with electronic copies of relevant documentation.

- When Procurement Services has completed the purchase request, the system requests authorization by email for spending approval.

- Notification to the requestor will be sent when the PO has been processed by procurement services.

Guidelines

Use the Navigating a New Purchase Guide to determine if the cheque requisition is the appropriate method to use for your spending request.

Use the Purchase Requisition End User Guide for assistance in understanding the purchase to pay purchase requisition form and process.

For all international purchases, consult the International Payments and Purchases page.

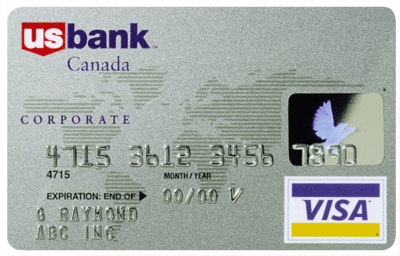

Purchasing Cards

The University uses the “US Bank in Canada” Purchasing Card program. The primary objective of the Purchasing Card System is to provide a convenient, cost-effective and efficient method of procuring and paying for lower dollar value goods and services by simplifying the Purchasing process, improving order cycle time, reducing paperwork, expediting vendor payments and empowering faculty, researchers and staff.

Departments may use PCards for the purchase and payment for goods and services where it is efficient, economical and operationally feasible to do so. System usage must comply with the procedures and guidelines contained in the Purchasing Card (PCard) Financial Policy and Purchasing Card (PCard) User Guide and related documents shown below.

To obtain a purchasing card, please complete the PCard Application Form and submit it to procurement@stfx.ca and use PCard in the subject line.

Need Help?

Questions about the application process or program may be directed to:

Documents

Cheque Requisition

Policy

All expenses on behalf of the University must adhere to the Purchasing Policy.

Forms

- Payment Requisition Express Email Form - Please email @email with subject: STFX PAYMENT REQUISITION EXPRESS EMAIL FORM. this form should be used to submit an invoice for payment of services which satisfy the valid expense type criteria as defined in the guidelines below (This email template may not be compatible with all web based email clients).

- Payment requisitions must be accompanied by actual invoices and any necessary support support documentation for Accounts Payable to process the payment. These must be attached to the payment request.

- If requesting reimbursement for business expenses paid personally, please use the University General Expense Form. Please ensure that the section titled "Purpose of Expense" is completed. Please note that multiple requests can be claimed on one General Expense Form.

Procedures

- Prepare the payment request by completing the appropriate Form linked above.

- Scan and attach any invoices, receipts, or other documents supporting the request in PDF format.

- Complete any additional forms applicable.

- Submit the approved form, receipts and invoices by email to the accounts payable department

- Once you have confirmed your invoices or receipts were correctly scanned and attached to the email to accounts payable, you may shred or dispose of them.

- When the payment requisition is being processed, the financial system will request authorization for the spending request by email spending approval request.

Guidelines

Use the Navigating a New Purchase Guide to determine if the cheque or payment requisition is the appropriate method to use for your spending request.

These forms should be used to request reimbursement only for the following list of specific items:

Standard Items:

- Referee Expense Claims

- Course Registrations

- Webinars

- Memberships/Dues Payments

- Hotel and Conference Facility Bookings (not accommodations)

- Where credit cards are not accepted or a PCard is unavailable use this form to request reimbursement for miscellaneous purchases less than $1,500 eligible for payment by PCARD

- Supplies and service for University owned vehicles

- Maintenance supplies (electrical, mechanical, building, etc.)

- Tools, small equipment

- Non hazardous chemicals

- Short term equipment rentals

- Mail/Phone/Web orders

- Books, subscriptions, etc.

- Research related goods and services (subject to exclusions above)

For all international purchases and payments, consult the International Payments and Purchases page.

Please note: The University's standard procedure is to mail cheques directly to the address provided by the payee.

Honoraria & Awards

Forms

- Honoraria and Awards Payment Requests - this document should be used to request cheques for student awards and honorarium payments for visiting lecturers and guest speakers

Procedure

- Prepare the cheque request by completing Honoraria and Awards Payment Requests form linked above.

- Scan and attach any documents, invoices, or receipts supporting the request.

- Complete any additional forms applicable.

- Submit the approved form and supporting documents to the accounts payable department

- When the payment request is being processed, the financial system will request authorization for the spending request by email spending approval request.

Guidelines

Use the Navigating a New Purchase Guide to determine if the cheque requisition is the appropriate method to use for your spending request.

Guidelines for Guest Lecturer/Speaker Remuneration detail the conditions of the honoraria and awards payment.

The University's standard procedure is to mail cheques directly to the address provided by the payee.

For all international payments, consult the International Payments and Purchases page.

Please note that Student Award and Honoraria payments require additional information for income tax purposes including a Social Insurance Number, Student ID number and Country of Residence (if payment is to a non-resident of Canada).

Honoraria payable to Canadian residents is considered employment income by Revenue Canada. A T4A Statement of Pension, Retirement, Annuity and Other Income will be issued.

Honoraria payable to non-Canadian residents will be reported on form T4A-NR (Statement of Fees, Commissions or Other Amounts Paid to Non-Residents for Services Rendered in Canada).

Non-residents are subject to withholding tax on all such fees received. To apply for a reduced amount of withholding tax, the individual must submit a Regulation 105 Waiver Application to Canada Revenue Agency (CRA).The approval letter from CRA must be submitted with the request form prior to payment in order for a reduced amount of tax to be processed.

Travel Claims

Policy

All travel expenses on behalf of the University must adhere to the Travel Policy

Forms

- Travel Claim Form - Use this form for domestic and international travel

- Supplemental Mileage Log Form - to be attached to expense report. This form is used by Faculty and students who are reimbursed quarterly for their mileage claims.

- Lost Receipt Declaration - this document to be submitted ONLY in the event original receipts have been lost, and copies cannot be obtained.

- Travel Advance Request - this document is to be submitted as per Travel Policy guidelines. *

Refer to AUT PD & Travel Expenses for details on professional development and travel expense claims relating to sections 1.2.2 and 2.1.2 of the AUT Collective Agreement.

*Note - Travel advances not cleared by the submission of an approved expense report within 30 days of trip completion will trigger the issue of a Revenue Canada T4A Statement of Pension, Retirement, Annuity and Other Income which adds the outstanding advance amount to your income.

Procedures

- Prepare a travel claim using the form and instructions in Forms Online.

- Complete any additional forms applicable.

- Receipts for travel must be submitted as per the travel policy – receipts should be submitted in the order they appear on the expense form.

- Submit the approved form and receipts to the accounts payable department

Guidelines

For all international payments, consult the International Payments and Purchases page.

Travel claim guidelines currently under development.

AUT PD & Travel

AUT Professional Development Fund

Policy

The AUT PD Expense program is defined by Article 1.22 Professional Expense Fund of the AUT Collective Agreement. All PD expenses reimbursed or processed must adhere to the AUT Professional Expense Fund Process Document. PD Expenses must also comply with other applicable University policies and regulations.

Forms

The PD Expense Form - this from should be used to request reimbursement of payment of goods and/or services supporting the AUT member's professional development.

Links:

Computer Equipment Form – Sign in to submit a request for new technology listed from the StFX Technology recommendation page. The questionnaire must be completed and flagged as a PD expense if the purchase is for an electronic device or accessory.

PD Entitlements - this link is only accessible by administration. Information is accessible available accessible to members via Dean/University Librarian’s office.

AUT Travel Fund

Policy

The AUT Travel Fund is defined by Article 2.12 Faculty Travel Budget of the AUT Collective Agreement.

Forms

AUT Faculty Travel Expense Form - this from should be used to request reimbursement for expenses related to preapproved AUT Travel Fund activity.

Please note the travel form listed above is exclusively for AUT travel fund reimbursement. All other travel must continue to use and comply with University procedures and forms.

Deposit Form

Forms

- General Deposit Form - Use this form to request a deposit of cash and cheques in addition to entry of debit and credit card receipts.

We recommend saving the file, and opening it with Excel for best performance.

Procedures

- Complete the General Deposit Form attached above including the total funds by payment type to be deposited and recorded for each unique account combination.

- Print and sign the form authorizing that you have counted the funds to be recorded and deposited.

- Send the completed form along with the cash, cheques, debit and/or credit card slips as indicated in the form to Student Accounts.

Guidelines

Contact Willissa DeCoste for questions on deposit procedures.

An example of a complete form can be found here.

International

International Payments and Purchases

International Payments

For all international payments requiring a wire transfer complete the Wire Transfer Request form.

International Purchases

It is important for all StFX personnel to be aware of Canada Customs requirements when ordering materials from suppliers outside Canada. Please review and be familiar with the Canada Customs Requirements if you will be importing goods from outside the country.

Wireless Devices

Policy

Wireless devices are governed by the Wireless Policy.

Forms

- Wireless Devices Request and Approval Form - this form is required to request a wireless device.

Procedures

- Complete the Wireless Devices Requests and Approval Form listed above.

- Print the form and obtain required signatures authorizing the device requested.

- Return the form to the IT Services Contact Centre for processing OR if requesting a tablet/iPad with no cellular plan, return this form with your purchase requisition to Procurement Services, 2nd Floor MacKinnon Hall.

Guidelines

Please contact IT Services for mobile device requirements.

Expense Coding Guidelines

Standard Sub-Accounts Guide - Expense Accounts

- This guidance is intended to assist with budget preparation, and expense coding. It is not an exhaustive list of expense sub-accounts, but these represent the sub-accounts broadly used across the university’s operations.

- If there are any of the sub-accounts listed that you would like to have paired with an account, please send a request to @email listing both the account and sub-accounts.

Contact

2nd Floor MacKinnon Hall

4130 University Avenue

Antigonish NS B2G 2W5

Canada